Understanding the Valuation of Oil Rigs

Valuing an oil rig is a complex process that requires a deep understanding of the oil and gas industry, market trends, and the intricate components that make up these massive structures. Whether you are a buyer, seller, or investor, knowing how to accurately assess the value of an oil rig is essential for making informed decisions. In this guide, we’ll walk you through the key factors and methodologies used in valuing oil rigs.

Key Factors in Oil Rig Valuation

1. Physical Condition

The current condition of an oil rig plays a significant role in its valuation. Factors such as corrosion, wear and tear, and overall structural integrity are assessed to determine the rig’s value. Well-maintained rigs with minimal signs of deterioration generally hold higher value.

2. Market Demand and Trends

Oil prices and market demand have a direct impact on the valuation of oil rigs. During periods of high demand and robust oil prices, rigs tend to have higher values due to increased operational potential. Conversely, low oil prices and reduced demand can lower the valuation.

3. Technological Advancements

Advancements in drilling technology can enhance the operational efficiency and potential yield of an oil rig. Rigs equipped with the latest drilling technologies and safety features may have a higher value due to their enhanced capabilities.

4. Geographical Location

The location of an oil rig also affects its valuation. Rigs located in areas with abundant oil reserves and favorable operating conditions tend to have higher values. Conversely, rigs in challenging environments may have a lower valuation due to increased operational risks and costs.

Methodologies for Oil Rig Valuation

1. Income Approach

The income approach values an oil rig based on its potential future income. This method considers factors such as projected oil production, operating expenses, and market conditions. The value is calculated by estimating the net present value of future cash flows the rig is expected to generate.

2. Market Approach

The market approach involves comparing the rig to similar rigs that have recently been bought or sold in the market. Comparable sales data is analyzed to determine a fair market value based on recent transactions.

3. Cost Approach

The cost approach calculates the value of an oil rig by considering the cost of building a similar rig from scratch, adjusting for depreciation and obsolescence. This method is especially useful for new or customized rigs where market data might be limited.

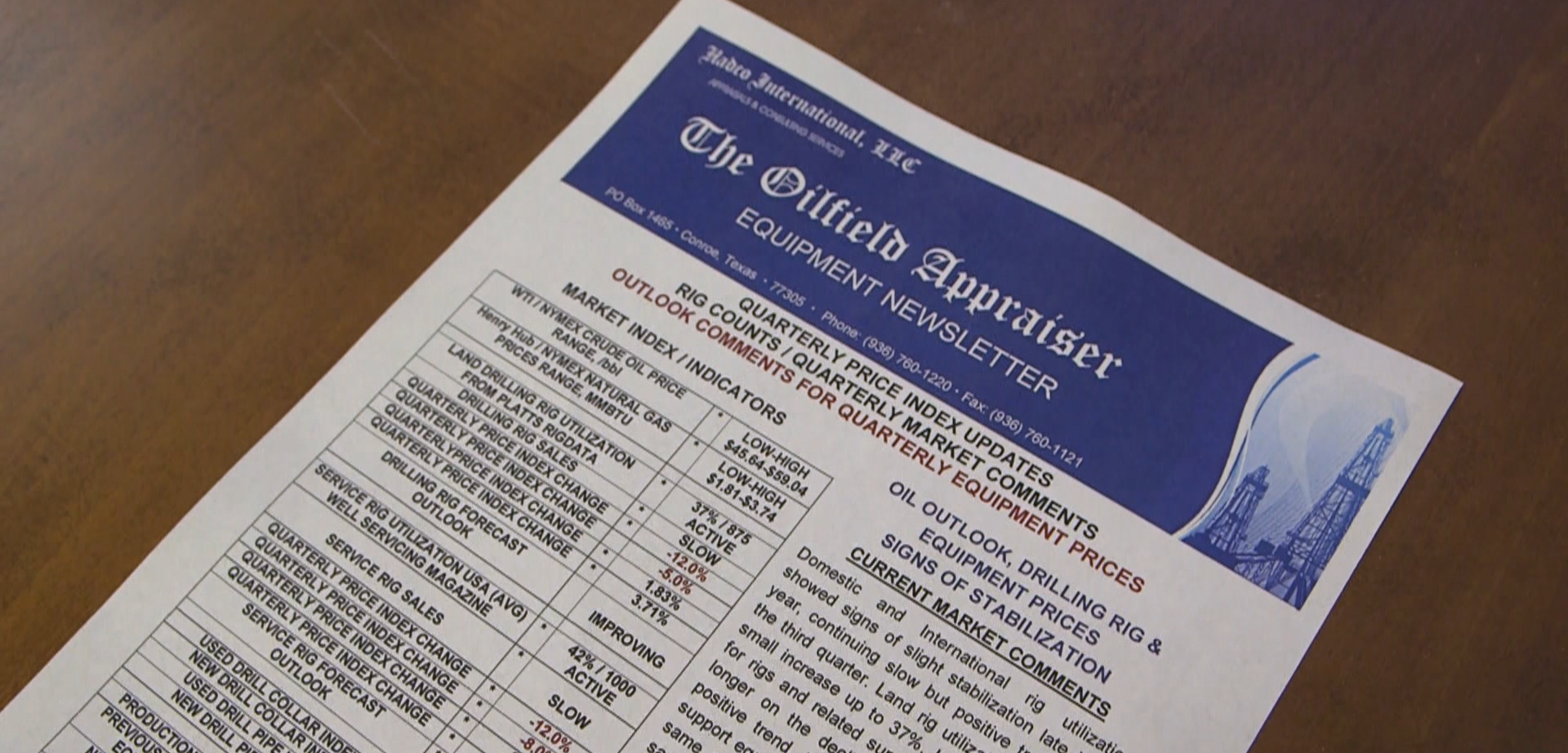

The Role of Expert Appraisers

Given the complexity of valuing oil rigs, seeking the expertise of professional appraisers is highly recommended. These experts have in-depth knowledge of the industry, market dynamics, and valuation methodologies. They conduct thorough inspections, analyze market trends, and apply appropriate valuation approaches to provide accurate and comprehensive valuations.

View More about Rig Valuation and Appraisal Services

Conclusion

Valuing an oil rig requires a combination of industry knowledge, market insights, and technical expertise. Understanding factors such as the rig’s condition, market demand, technological advancements, and geographical location is essential. Utilizing income, market, and cost approaches helps determine a precise valuation.

To ensure accurate and reliable oil rig valuations, partnering with experienced appraisers is key. Their insights and methodologies guide your decision-making, whether you’re considering a purchase, sale, or investment. Remember, when it comes to valuing oil rigs, precision is paramount.

For expert oil rig valuation services that deliver thorough and documented opinions of value, trust Hadco International to provide you with the insights you need. Contact us today to discover how we can assist you in accurately valuing your oil rig assets.