The world of equipment appraisal is vast and varied, with each asset type requiring its unique approach to valuation. Two significant assets in the energy sector are oilfield equipment and pipelines. While they both fall under the broader umbrella of the oil and gas industry, their appraisal methods differ considerably due to their distinct characteristics and operational nuances. In this comprehensive exploration, we’ll compare the appraisal methods for oilfield equipment and pipelines, shedding light on their differences and the reasons behind them.

Oilfield Equipment Appraisal

Characteristics:

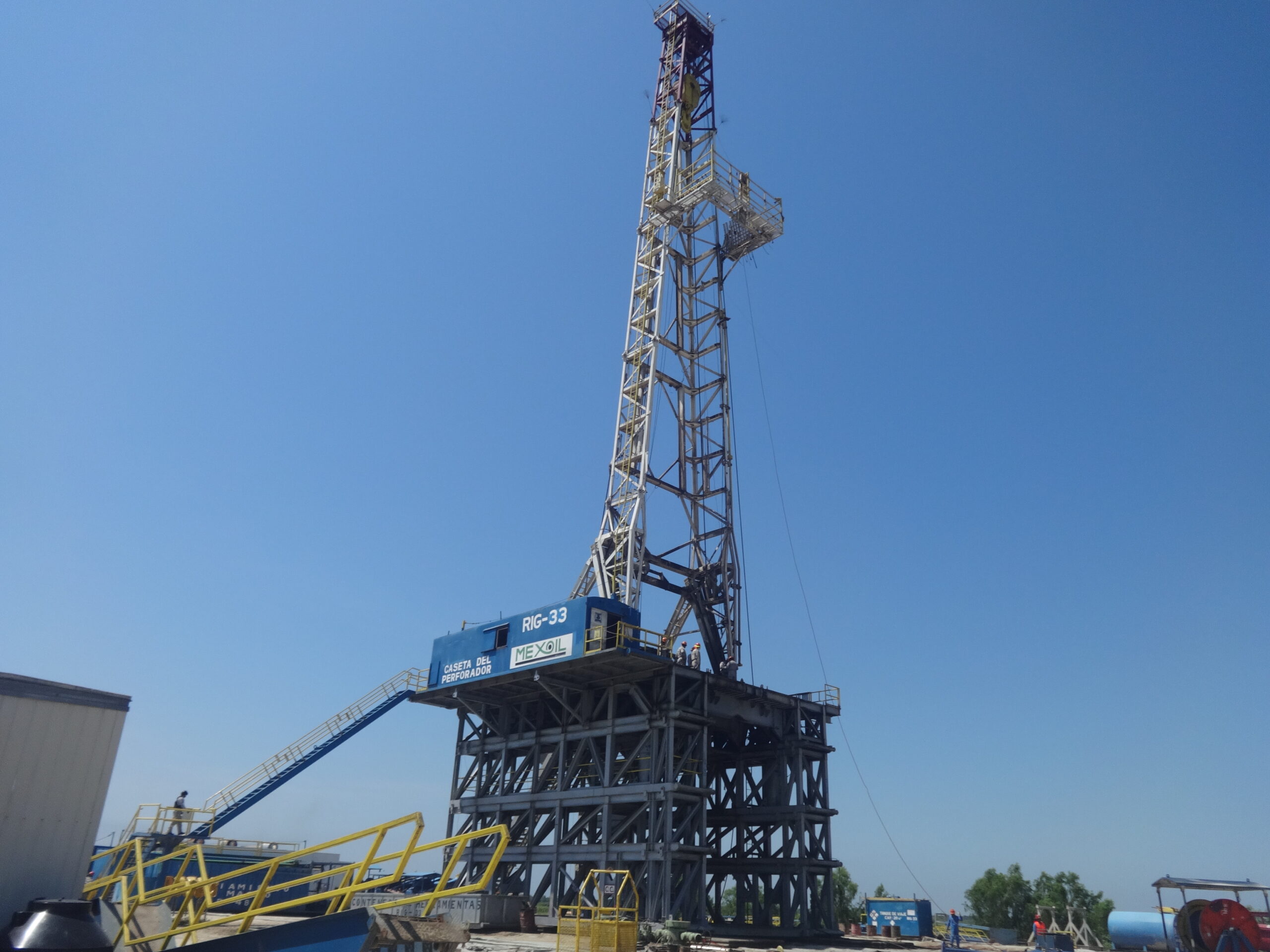

- Oilfield equipment encompasses a wide range of machinery, from drilling rigs and pumps to storage tanks and transportation vehicles.

- The equipment’s lifespan, wear and tear, and technological advancements play a significant role in its value.

Appraisal Methods:

- Market Approach: This method involves comparing the equipment to similar items recently sold in the market. Factors like age, condition, and specifications are considered.

- Cost Approach: Here, the appraiser calculates the current replacement cost of the equipment and then subtracts depreciation.

- Income Approach: This method is based on the potential income the equipment can generate. It’s especially relevant for equipment that directly contributes to production.

Pipeline Appraisal

Characteristics:

- Pipelines are extensive structures that transport oil or gas across vast distances.

- Their value is influenced by factors like length, diameter, material, location, and the volume of oil or gas they transport.

Appraisal Methods:

- Market Approach: Due to the uniqueness of each pipeline, finding comparable sales can be challenging. However, when available, such sales can provide valuable insights.

- Cost Approach: This method is commonly used for pipelines. It involves calculating the current replacement cost of the pipeline and then accounting for depreciation.

- Income Approach: Given that pipelines generate income through transportation tariffs, this method calculates the present value of future income streams.

Real-World Scenario: The Tale of Two Appraisals

Consider an energy company that owns both oilfield equipment and a series of pipelines. They approach Hadco International for appraisals. The Hadco team, recognizing the distinct nature of the assets, employs different strategies for each.

For the oilfield equipment, the team conducts a thorough on-site inspection, assessing the condition, operational history, and technological relevance of each piece. They use a combination of market and cost approaches to determine the equipment’s value.

For the pipelines, given their extensive nature, the team uses satellite imagery and GIS data for assessment. They heavily rely on the cost approach, given the unique characteristics of each pipeline, and factor in the income potential based on transportation tariffs.

This scenario underscores the importance of understanding each asset’s nature and employing the appropriate appraisal method.

Conclusion

While oilfield equipment and pipelines both play crucial roles in the energy sector, their appraisal methods differ considerably. Recognizing these differences and ensuring that appraisals are conducted with expertise and precision is paramount. By partnering with seasoned professionals like those at Hadco International, companies can ensure accurate and tailored valuations for their diverse assets.